Genuine green steel or greenwashing? Common labeling rules are needed to benefit the climate and business

Current methods of green steel labeling are confusing due to a lack of standardization and complexity in environmental impact assessments. How should labeling be developed to ensure sufficient emission reductions, customer trust and fair competition?

The steel industry is about to undergo a major disruption, as an industry-wide shift to low-emission production methods is urgently needed to limit global warming. The transformation will affect the industry also in terms of competition, as new players emerge and established ones must implement efficient strategies to reach decarbonization targets. Due to keen public interest and costs, governments, international organizations, and the financial sector also have a major role to play.

To achieve sufficient emission reductions in steel production, there are already several methods and technologies available. One is substituting the virgin iron ore by using steel and iron scrap. One is reducing steel by using hydrogen-based technologies instead of coke. Both of these methods have already been implemented by some producers and proven to be efficient New and promising innovations, such as electrolysis of iron ore, have also emerged but need to be further developed. Also, in the case of traditional blast furnaces, carbon capture and storage (CCS) as well as more marginal fuel changes and process optimization have been applied to reduce emissions but will play a minor role compared to more efficient technologies.

The production technologies used will also affect the end product’s specifications regarding its ‘greenness.’

Fair competition through standardization

When it comes to green steel labeling[1], the scope and boundaries of product declarations are often unclear. Instead of assessing only the climate impacts of steel production, the end product’s entire life cycle should be considered. Thus, for example, embedded CO2 per ton of steel should not be used as the sole metric for determining the ‘greenness’ of steel. Nevertheless, emission intensity information should always be presented consistently in product specifications to enable justified procurement decisions and a fair carbon tariff on imported steel.

Due to a lack of common labeling rules, steel companies should, for the time being, rely on accepted standards and company-level emission reduction pathways based on climate science when forming their climate claims. At least two key factors should be kept in mind: Is the product compatible with the net zero target, and is it produced using renewable energy?

One way to clarify product labeling could be a new green steel ISO standard that all steel producers would need to rely on. This would also ensure that the competitive environment remains fair and steel producers play by the same rules. It is important to ensure the credibility of the system so that the labeling is also somehow monitored and climate claims are validated.

Responsible procurement

For steel buyers, procuring genuinely low carbon steel when possible is a safe strategy in terms of both the climate and corporate image. However, procuring green steel might not be an easy task, as the lack of common rules and control allow greenwashing with green steel labels. Although weeding out greenwashing is mainly the responsibility of the manufacturers and legislators, companies should understand their responsibilities in steel procurement.

For example, some steel producers promote specific premium-priced green steel product labels with the only difference to other products from the same process being that all claimed CO2 reductions linked to the specific production process have been allocated to the product with the green steel label. For the present, this practice can be defended if the green premium is used for further emission abatement investments. When procuring green steel products, the buyer should always be aware of the rationale behind the claims.

Precise targets increase credibility

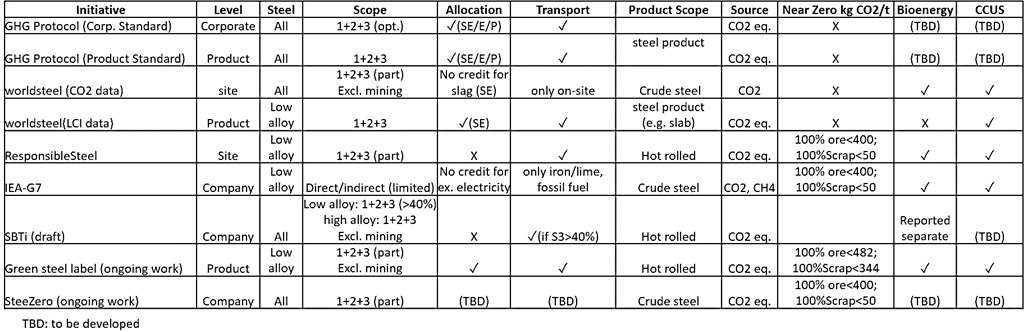

Since the current green steel labeling practices are confusing and the climate claims behind the product labels are unclear, stricter regulation and better incentives are needed. Currently, there is a large number of different standards, protocols, and initiatives that focus on green steel (see Tables 1 and 2). However, only three of the producer-focused standards and initiatives – ResponsibleSteel, SBTi, and the IEA – provide specific numerical targets for tons of CO2 emitted per ton of steel produced.

Table 1: Summary of the focus of the current steel industry standards, protocols, and initiatives (Source: Hasanbeigi & Sibal 2023).

Table 2: Summary of Green Steel standards (Source: Kobolde & Partners, 2023).

The green transition will take time and funds to build the required electricity, hydrogen, and steel production facilities. A credible and ambitious emission abatement roadmap is needed to secure financing and a customer base. The Science Based Targets initiative (SBTi) provides efficient tools for this purpose and helps to ensure science-based emission reduction targets at the company level. While SBTi as such does not define the prevailing emission intensity in a company’s individual product labels, green steel product labels may be part of the company’s strategy to implement their SBTi pathway.

What kind of green steel labels are there?

Steel producers’ green steel labels can be categorized as follows:

-

1. Recycled steel in electric-arc furnaces (EAF) using low-emission electricity

- The main factor that determines emissions is the electricity used in the electric-arc furnace process.

- Some steel product labels that are already on the market, like SSAB’s Zero™, Outokumpu’s Cycle Green® and thyssenkrupp’s bluemint® recycled, are labeled as ‘green’ because they are made from recycled steel and iron scrap. However, while scrap steel and iron as raw materials are usually considered to have no emissions, increased demand for scrap could indirectly increase demand for primary iron ore.

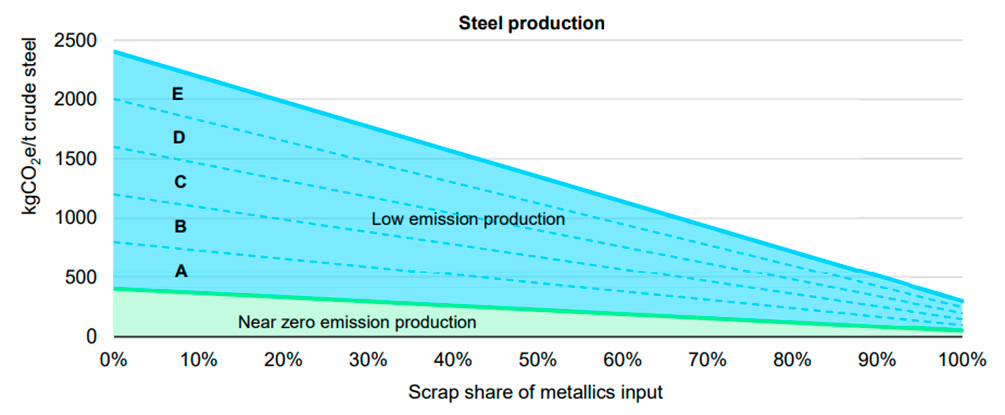

- According to the IEA, if 100% scrap is used to produce steel, the resulting emissions can be considered near zero if they are below 50 kg CO2 per ton of steel produced.

-

2. Hydrogen-based technology (DRI-EAF)

- Electric-arc furnaces combined with direct-reduced iron (made using green hydrogen) emit almost no greenhouse gases (according to the IEA, steel production can be considered near-zero emissions if it emits less than 400 kg of CO2 per ton of steel produced).

- This technology will use renewable electricity to produce green hydrogen, which will be used to make steel. These products will likely first be used in high-end consumer goods, like upper segment cars, and are expected to hit the market within the next few years.

- One example of a green steel product label based on DRI-EAF technology is SSAB’s Fossil-free™ steel, which is made from iron ore without fossil fuels.

- If the steel producer’s scrap ratio is somewhere between 0% and 100%, the emission intensity thresholds are applied in proportion to the scrap ratio.

Picture 1: IEA’s near zero emission crude steel production threshold as a function of scrap use and proposed classification system (Source: Levi et al., 2022).

-

3. Minor emission reductions in coal-based production (BF-BOF)

- Some companies are labeling their steel products as “virtually green” and claiming to have lower emissions, even though they have not made significant changes to their production process. The claimed abatement credits are sometimes allocated to specific “virtually green” steel product labels targeted to markets willing to pay a green premium and hence being able to claim that their Scope 3 emissions are smaller. Examples of such product labels include thyssenkrupp’s bluemint® pure, ArcelorMittal’s XCarb™, Nippon Steel’s NSCarbolex™ Neutral, Voestalpine’s isovac® greentec steel, Kobe Steel Kobenable Premier, and Tata Steel Europe’s Zeremis™ Carbon Lite.

- DNV, an assurance institute that provides green steel verification services, states that the purpose is “to incentivize the steelmaking companies to carry out initiatives that reduce direct or indirect emissions in today’s infrastructures instead of waiting for major steps in switching technologies to take place in the decades to come.” However, it is important to note that any improvements made to the steel-making process should not be used for greenwashing.

- The IAE reference value for BF-BOF emission intensity is quite high, at 2,945 kg CO2 per ton of steel. Even the natural-gas-based DRI-EAF reference value is only half that. Therefore, it is important to move towards greener alternatives like DRI-EAF. Also, it should be clear that no further BF-BOF capacity should be built.

-

4. New innovations

- While promising new technologies are being developed, the future cannot be built on potential innovations. Emission reduction pathways in the steel sector must rely on the methods and technologies that are ready and available.

- Iron ore electrolysis (e.g., Molten Oxide Electrolysis [MOE] by Boston Metal) is a promising emerging technology that bypasses the need for hydrogen production and storage.

- Pyrolysis CCS is another promising technology applied to hydrogen production from natural gas or biogas (Hycamite).

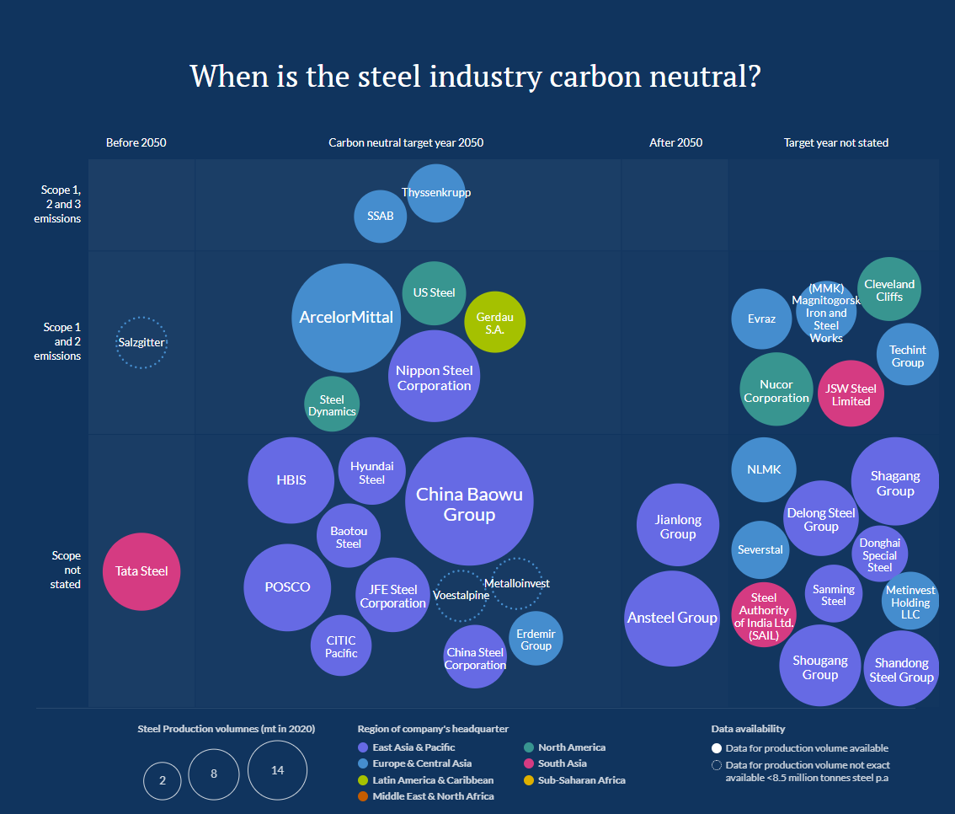

Picture 2: A comparison of steel producers and their carbon neutrality (source: Industry Transition).

[1] A product label is a piece of information attached to a product to provide more details about the product and to help customers make informed decisions. While comparing the terms brand and product label, a brand is a broader concept that encompasses the company’s overall image and reputation, while a product label is a specific piece of information that provides details about a particular product.

Antti Jokinen

Senior Advisor, WWF Finland

[email protected]

Kirsi Vuorinen

Project manager, Steel decarbonization, WWF Finland